"No Taxation Without Representation"

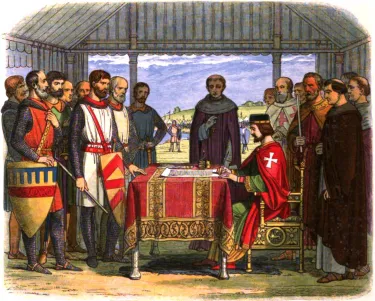

Perhaps no phrase is used more to describe the grievances of the colonists in the lead up to the American Revolution than “No taxation without representation!” While the exact phrase did not appear until 1768, the principle of having consent from the people on issues of taxation can be traced all the way back to the Magna Carta in 1215.

The Magna Carta was one of the first steps in limiting the power of the king and transferring that power to the legislative body in England, the Parliament. Parliament had the power to levy taxes. When King Charles I attempted to impose taxes by himself on the English people in 1627, the Parliament passed the Petition of Right the following year, which stated that the subjects of the king “should not be compelled to contribute to any tax, tallage, aid, or other like charge not set by common consent, in parliament.”

The Magna Carta, the Petition of Right and the English Bill of Rights from 1689 helped to form the basis of the British constitution (which is not a single document, but a combination of written and unwritten agreements). The British constitution protected the rights of Englishmen. English colonists in North America believed that they had the same rights of Englishmen. In North America, colonists formed their own colonial governments under charters from the king and regulated their own forms of taxation from their colonial legislatures. For many decades, these colonies enjoyed an extended period of benign neglect as the English parliament let them handle taxation on their own.

In Great Britain in the eighteenth century, there were no income taxes because it was viewed as too much of a government intrusion into the lives of the people. Instead, taxes were placed on property and on imported and exported goods. Money from these taxes helped to pay for public goods and services and supported the government’s military for defense.

In North America, the British colonies regulated their own tax system in each individual colony. These taxes, though, were exceedingly low, and the colonies did not have a professional military to support. Instead, they used a volunteer militia system to defend their towns and homes from attacks along the frontier.

In 1754, the French and Indian War broke out in North America. During the war, the British sent their military to help defend the colonies. The war spread across the globe and became known as the Seven Years’ War. Following Britain’s victory in 1763, the British national debt greatly increased. They now had a larger empire now that needed to be defended. In light of this tenuous situation, and since the North American colonists benefitted directly from the British military during the war, Great Britain looked to levy taxes on the colonists to raise revenue for the Crown.

In Massachusetts in 1764, James Otis published a pamphlet titled “The Rights of the British Colonies Asserted and Proved,” which argued that man’s rights come from God and that governments should only exist to protect those natural rights. He believed that any attempt to tax the colonists without their consent violated the British constitution. Here, Otis made a compelling argument for the need for representation in any taxation on the colonies: “no parts of His Majesty’s dominions can be taxed without their consent; that every part has a right to be represented in the supreme or some subordinate legislature; that the refusal of this would seem to be a contradiction in practice to the theory of the constitution.”

In 1764, the British Parliament passed the Sugar Act, which revised a 1733 tax on molasses being imported to the North American colonies from the West Indies. It improved the enforcement of this tax and explicitly stated that the reason was to raise revenue, a first of its kind. American colonists, especially in New England, responded furiously to this new tax.

Samuel Adams said in response to the Sugar Act: “If taxes are laid upon us in any shape without ever having a legal representative where they are laid, are we not reduced from the character of free subjects to the miserable state of tributary slaves?”

While the colonists likened their situation to slaves of the British Empire, American colonists paid very little in taxes compared with their counterparts in Great Britain. In Great Britain, a person paid about 26 shillings a year in taxes, while in America, they still paid only 1 shilling a year in taxes. Despite this, the American colonists strongly opposed the tax and the lack of any power to influence the decisions of Parliament.

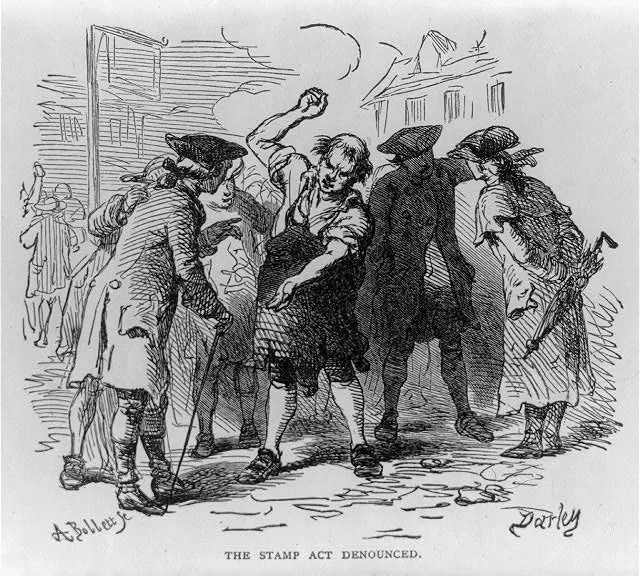

The following year, in 1765, Parliament passed the Stamp Act, which levied a tax on many paper goods (such as newspapers, pamphlets, and legal documents) within the colonies. American colonists met the Stamp Act with protests and outrage. Protests included violence against tax collectors, the formation of the Sons of Liberty, and the creation of numerous “Liberty Trees” where gatherings and demonstrations against British overreach were displayed. In October 1765, delegates from nine different colonies gathered in New York at the Stamp Act Congress. They passed a Declaration of Rights and Grievances in which they asserted in part “that it is inseparably essential to the freedom of a people, and the undoubted rights of Englishmen, that no taxes should be imposed on them, but with their own consent, given personally, or by their representatives.”

The Stamp Act became so unpopular that in 1766 Parliament repealed the act. However, they also passed a Declaratory Act that directly contradicted the colonists view on the authority to levy taxes. The Declaratory Act noted that Parliament “had hath, and of right ought to have, full power and authority to make laws and statutes of sufficient force and validity to bind the colonies and people of America, subjects of the crown of Great Britain, in all cases whatsoever.”

In 1768, the catchphrase of “No taxation without representation” first appeared in a London newspaper. As debate continued throughout the 1760s and 1770s over whether the Crown had the right to tax the colonial subjects, the phrase grew more and more popular. It provided an ideological argument in a short and powerful way against many of the subsequent taxes, such as the Townshend Acts in 1767 and 1768 and the Tea Act in 1773. As the colonies grew more and more rebellious to these taxes, the Crown pushed back stronger and only further drove the two parties towards organized conflict. Conflict finally ignited in 1775, and by the following year, the colonies united and declared their independence from Great Britain.

In 1778, Parliament finally passed the Taxation of Colonies Act which repealed the taxes, but by that point it was too late. What had begun as an argument over the ability and right to levy taxes had expanded into a conflict over the right of self-determination and freedom.

Today, the phrase “No taxation without representation” continues to be used by people who want to have a say in how they are taxed. It remains a powerful phrase that provokes people to think about the consent of the governed.